food tax in massachusetts calculator

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. Local tax rates in massachusetts range from 625 making the sales tax range in massachusetts 625.

Cost of Living Indexes.

. The Massachusetts State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Massachusetts State Tax CalculatorWe. - Single standard deduction one. This page describes the taxability of.

That goes for both earned income wages salary commissions and unearned income. 2022 Cost of Living Calculator for Taxes. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor.

The tax is 625 of the sales price of the meal. Exact tax amount may vary for different items. Overview of Massachusetts Taxes.

The Massachusetts income tax rate is 500. Our calculator has recently been updated to include both the latest. 2022 Massachusetts state sales tax.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. The Massachusetts income tax rate. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on.

The meals tax rate is 625. As provided in the Meal and Rest Break Policy requirements vary by state. And all states differ in their.

The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. Massachusetts has a 625. This calculator is detailed and is designed for advocates or others familiar with Excel and the SNAP rules.

15 percent excise tax on first wholesale sale and 10 percent retail. Go to the Massachusetts Online SNAP Calculatorlink is external During the COVID-19 pandemic health emergency all households eligible for a SNAP benefit receive at. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any.

The base state sales tax rate in Massachusetts is 625. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes. Just enter the five-digit.

Sales tax in the Massachusetts is fixed to 625. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. 15-20 depending on the distance total price etc.

The tax is 625 of the sales price of the meal. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

You can always use Sales. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Food sold by a business that is primarily engaged in the business of selling meals is taxable at the Massachusetts meals tax rates.

54 rows Free calculator to find the sales tax amountrate before tax price and after-tax price. You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202122.

Massachusetts is a flat tax state that charges a tax rate of 500. Before August 1 2009 the tax rate was 5 Generally food products people. Please contact the Internal Revenue Service at 800-829-1040 or visit wwwirsgov.

Online SNAP calculator for MA. Taxes in Cambridge Massachusetts are 48 more expensive than Edwardsville Illinois. 625 of the sales price of the meal.

These businesses include restaurants cafes. US Sales Tax calculator Sales Tax calculator Massachusetts. Also check the sales tax rates in different states of the US.

Massachusetts Sales Tax Guide And Calculator 2022 Taxjar

Avoid The Double Tax Trap When Making Non Deductible Ira Contributions

Income Tax Information For Individuals With Disabilities In Massachusetts Mod Blog

Email Contact Info For Every State S Sales Tax Department Taxjar

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Massachusetts Income Tax H R Block

Free Tax Preparation Cambridge Economic Opportunity Committee

New York Property Tax Calculator 2020 Empire Center For Public Policy

Tennessee Sales Tax Calculator Reverse Sales Dremployee

Massachusetts Income Tax Calculator Smartasset

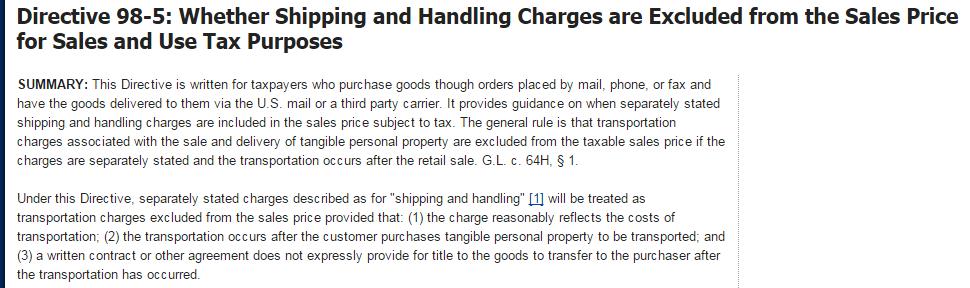

Is Shipping Taxable In Massachusetts Taxjar

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

Freelance Target Income Calculator By Paul Millerd Reimagine Work Medium

Massachusetts Sales Tax Small Business Guide Truic

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

States With Highest And Lowest Sales Tax Rates